7 SaaS Pricing Hacks: How to Maximize Annual Subscriptions for Growth

SaaS is one of the best business models out there.

You get stable revenue every month. And as customers increase their usage, revenue expands without needing new customers.

But there’s a hidden problem that kills growth.

The cash flow trap most SaaS companies fall into

Monthly revenue is too slow. It takes forever to recover your CAC (customer acquisition cost).

Think about a normal e-commerce business.

You spend $100 to acquire a customer. They buy a $300 product. You collect that $300 immediately and reinvest it into more ads the same day.

It’s a fast cycle.

SaaS doesn’t work this way. If you’re charging $10/month, you need 10 months just to break even on a $100 CAC.

That’s 10 months before you can reinvest that money into growth.

This is why annual plans are on page one of the SaaS playbook.

Annual rate matters more than you think

When your annual subscription rate drops, your compound growth declines.

Here’s a real example:

Scenario A: 70% annual subscription rate, $12/month or $120/annual

Scenario B: 30% annual subscription rate after price hike, $15/month or $144/annual

Which grows faster?

Scenario A. By a massive margin. You’ll have twice the revenue in 3 years, even though the prices are much lower.

This means you need to watch two things at once: price and annual subscription rate. They’re connected.

The problem? Annual rates drop when the economy tightens or when you raise prices (I wrote about common price hike mistakes here).

So how do you keep your annual rate high?

Here are 7 pricing hacks that work.

1. Make annual the default mental choice

Show the annual by default. And let users switch to monthly by pressing a button.

Many companies still do this backwards.

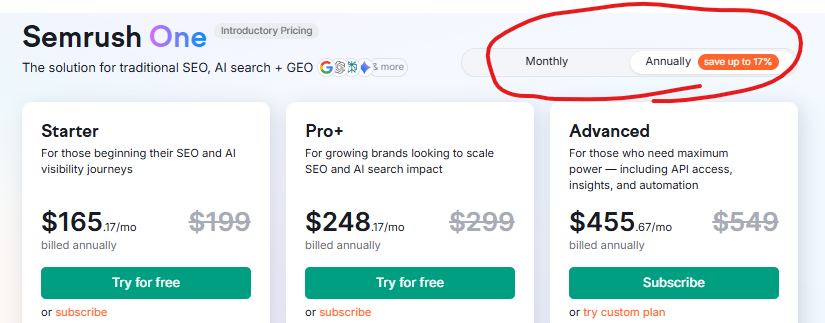

Example: https://www.semrush.com/pricing

If you want to sell annual plans, make them the default. Don’t give monthly equal weight on your pricing page.

You can make it even harder. Add a tiny “see monthly pricing” link. Or require visitors to contact sales for monthly rates.

Just don’t hide pricing completely. That destroys trust.

Also, even for annual plans, show the price as $/month (billed annually), not $/year.

Why?

It makes the price less intimidating than showing the total. And visitors can easily compare it to the monthly plan price.

2. Reframe the comparison: “saving” vs “waste”

Most companies frame pricing like this:

Monthly: $29/mo

Annual: $24/mo (save 17%) billed annually

Try this instead:

Monthly: $29/mo (+21% as a handling fee)

Annual: $24/mo billed annually

This flips the entire narrative.

Before:

Monthly = the normal option

Annual = if you pay upfront, you get a bonus (savings)

After:

Monthly = you pay extra as a handling fee (a loss)

Annual = the “normal” price

Why does this work?

People don’t act to gain $100. But they will act to avoid losing $100.Your brain is programmed this way.

For early humans, losing resources often meant death. On the other hand, extra food simply rotted. — that instinct still stays with us.

Loss aversion is a far bigger motivator than potential gain.

There’s also a math trick here.

Going from $29 to $24 is a 17% discount.

But going from $24 to $29 is a 21% premium.

Of course, 21% looks more significant than 17%. You can show a bigger number when you frame it as an additional cost rather than a discount.

3. Show the total cost of indecision

Add a small line of text below your pricing. It’s subtle, but powerful:

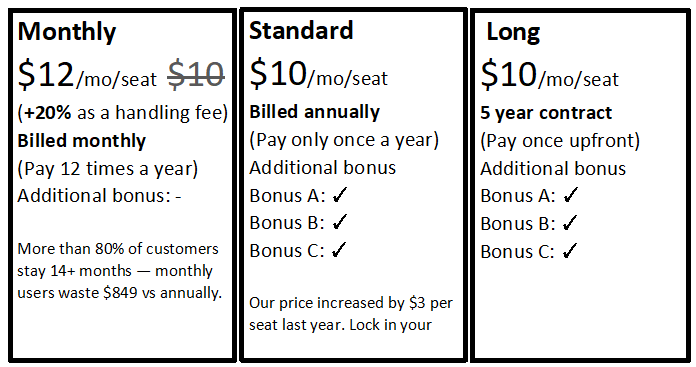

“Over 80% of customers stay 14+ months — monthly users waste $849 compared to annual.”

This works especially well when:

- You have decent retention numbers to back it up

- Your price is high enough to show significant waste

4. Show them the advantages of choosing annual

There are several benefits you can highlight.

Price lock guarantee

Annual customers lock in their current price for the full year.

If you’ve historically raised prices, show them the trend. Prices never go down—they keep going up.

By paying annually, they avoid the waste of paying more after a mid-year price hike.

This works even better with multi-year contracts. “Apply now and secure 3 years at the same price, protected from future price increases.”

This is a great deal for you too. You get 3 years of fees upfront. You can immediately reinvest that cash for faster growth.

Convenience and simplicity

Tell them they don’t have to handle billing 12 times a year. They pay once and forget about it.

One transaction. One receipt. One line item on their accounting.

Much more convenient for them.

5. Use price discounts strategically

Of course, you can offer a steeper annual plan discount to get more annual subscribers.

But balance is critical. You need to find the sweet spot between discount depth and annual plan rate.

The goal is to pick the price that compounds your growth the most.

The most useful metrics here are:

- ROI

- First month cash inflow / CAC rate

I explained how to use these metrics for pricing decisions here.

Compare those metrics. Then decide.

6. Offer annual plans to existing monthly subscribers

Don’t forget about customers who are already paying monthly. Show them the annual plan option constantly.

If you find a big customer using your product heavily, make a sales call. Pitch them on switching to annual.

They’re serious users—they should be on an annual plan.

If your annual rate is very low, you can even offer a cancel‑anytime policy. It removes the user’s risk entirely:

“Switch to annual. Cancel anytime — unused months refunded.”

7. Use decoy pricing

Decoy pricing means adding a pricing tier specifically to make your target tier more attractive by comparison.

Think of it like this: if you bring a friend who’s similar but less attractive (maybe they’re broke), you become more attractive in comparison.

I wrote about decoy pricing before (see this article).

But today I’m giving you the definitive version.

This technique is extremely powerful. But it requires dynamic pricing page changes. So it’s best used when your annual subscription rate is low—below 50%.

Here’s the best pricing display:

Most pricing pages work like this:

Choose annual or monthly first → then pick which tier

The annual-first display flips this:

Choose pricing tier first → then choose annual or monthly

The three-option structure:

Instead of just “Monthly” and “Annual,” show three options:

- Monthly

- Standard (this is your annual plan)

- Long (this is the decoy)

By calling annual “Standard,” you signal that normal people pick this option. Monthly becomes abnormal—something you pay a premium for.

Why the “Long” option is a great decoy:

Adding a “Long” option (maybe 3-year or 5-year) makes the annual plan look short-term by comparison.

Now both monthly and annual feel “short.” The only difference? Price and bonuses.

Annual has a lower price and more bonuses than monthly. It becomes a no-brainer.

The middle option effect:

Also, the decoy makes the annual plan the middle option.

Not too short. Not too long.

People psychologically tend to pick the middle option. It feels safe and reasonable.

The bottom line

Annual subscriptions are the engine of SaaS growth.

They accelerate cash collection. They reduce churn. They let you reinvest faster.

Remember: a SaaS with 70% annual rate at lower prices compounds twice as fast as one with 30% annual rate at higher prices.

What to do next:

Check your current annual payment rate. If it’s less than 60%, start implementing these tactics today.

Pick 2-3 hacks. Test them. Track results.

The companies that master annual subscriptions win.